Summary:

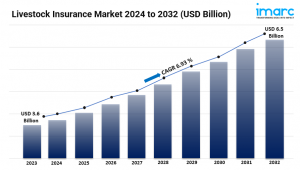

- The global livestock insurance market size reached USD 3.6 Billion in 2023.

- The market is expected to reach USD 6.5 Billion by 2032, exhibiting a growth rate (CAGR) of 6.93% during 2024-2032.

- North America leads the market, accounting for the largest livestock insurance market share.

- Mortality accounts for the majority of the market share in the coverage segment as it directly addresses the financial losses incurred from the death of animals.

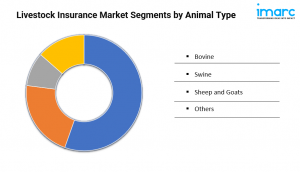

- Bovine holds the largest share in the livestock insurance industry, based on the animal type. This is due to the significant economic value and the high number of cattle raised for beef and dairy production globally.

- Direct channels remain a dominant segment in the market, as they offer a straightforward and cost-effective way for farmers to purchase insurance policies.

- The rising knowledge of the risks associated with the farming of livestock is a primary driver of the livestock insurance market.

- Technological advancements and innovations in data analytics and satellite imaging are reshaping the livestock insurance market.

Request to Get the Sample Report: https://www.imarcgroup.com/livestock-insurance-market/requestsample

Industry Trends and Drivers:

- Growing Awareness of Livestock Risks:

The increasing consciousness among farmers and ranchers of the financial implications of animal diseases, natural disasters, and accidents in livestock farming is acting as a growth-inducing factor. Moreover, the rising prevalence of diseases such as foot and mouth disease (FMD) and avian influenza, highlighting the importance of insurance coverage is bolstering the market growth.

Additionally, the growing frequency of extreme weather events, attributed to climate change, that lead to the awareness of the potential losses that can occur from natural disasters is anticipated to drive the market growth. Along with this, the increasing focus of farmers on investing in livestock insurance to safeguard against unexpected financial setbacks and to ensure the stability of their operations is fueling the market growth.

- Rapid Technological Advancements in Risk Assessment:

The rising innovations such as data analytics, satellite imaging, and the Internet of Things (IoT) devices that transform how risks are assessed and managed in the livestock sector are creating a positive outlook for the market. For instance, satellite imaging and remote sensing technologies allow insurers to monitor environmental conditions and assess risk factors more accurately. Moreover, data analytics enable insurers to evaluate historical data and predict potential risks with greater precision.

Besides this, IoT devices can track the health and location of livestock in real time, providing valuable information that can be used to prevent losses and optimize insurance policies. These technological improvements enhance the accuracy of risk assessments and streamline the claims process, making insurance more accessible and efficient for livestock owners.

- Expansion of Insurance Products and Coverage Options:

The expansion of insurance products and coverage options is another key factor driving the market growth. Moreover, the increasing focus of insurers on offering a diverse range of products tailored to different types of livestock and farming practices is boosting the market growth. This includes coverage for diseases, accidents, theft, and income loss due to reduced productivity.

Moreover, the introduction of customized insurance policies that are designed to meet the specific needs of various livestock operations, such as small-scale farmers and large commercial enterprises, is enhancing the market growth. Besides this, the development of new products, such as parametric insurance that pays out based on predefined triggers rather than actual losses, offering additional flexibility and protection, is stimulating the market growth.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=8024&flag=C

Livestock Insurance Market Report Segmentation:

Breakup By Coverage:

- Mortality

- Revenue

- Others

Mortality account for the majority of shares as this coverage provides essential protection and compensation, making it a fundamental component of most livestock insurance policies.

Breakup By Animal Type:

- Bovine

- Swine

- Sheep and Goats

- Others

Bovine dominates the market owing to the extensive use of cattle in agriculture and their substantial market value.

Breakup By Distribution Channel:

- Direct

- Agency/Broker

- Bancassurance

Direct channels hold the majority of shares as this channel reduces the need for intermediaries, allowing for more personalized services and potentially lower premiums for policyholders.

Breakup By Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the leading position owing to a large market for livestock insurance driven by its well-established agricultural sector, significant livestock population, and high levels of insurance penetration.

Top Livestock Insurance Market Leaders: The livestock insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- AXA XL

- FBL Financial Group, Inc

- Future Generali India Insurance Company Ltd.

- HDFC ERGO General Insurance Company

- Howden Insurance & Reinsurance Brokers (Phil.), Inc.

- HUB International Limited (Hellman & Friedman LLC)

- ICICI Lombard General Insurance Company Limited

- Liberty Mutual Insurance Company (Liberty Mutual Group Inc.)

- Lloyd’s

- Nationwide Mutual Insurance Company

- The Hartford

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145