Silver Price In USA

- United States: 748548 USD/MT (H2 2023 Avg Price)

The price of Silver in the United States for H2 2023 reached 748548 USD/MT (H2 2023 Avg Price).

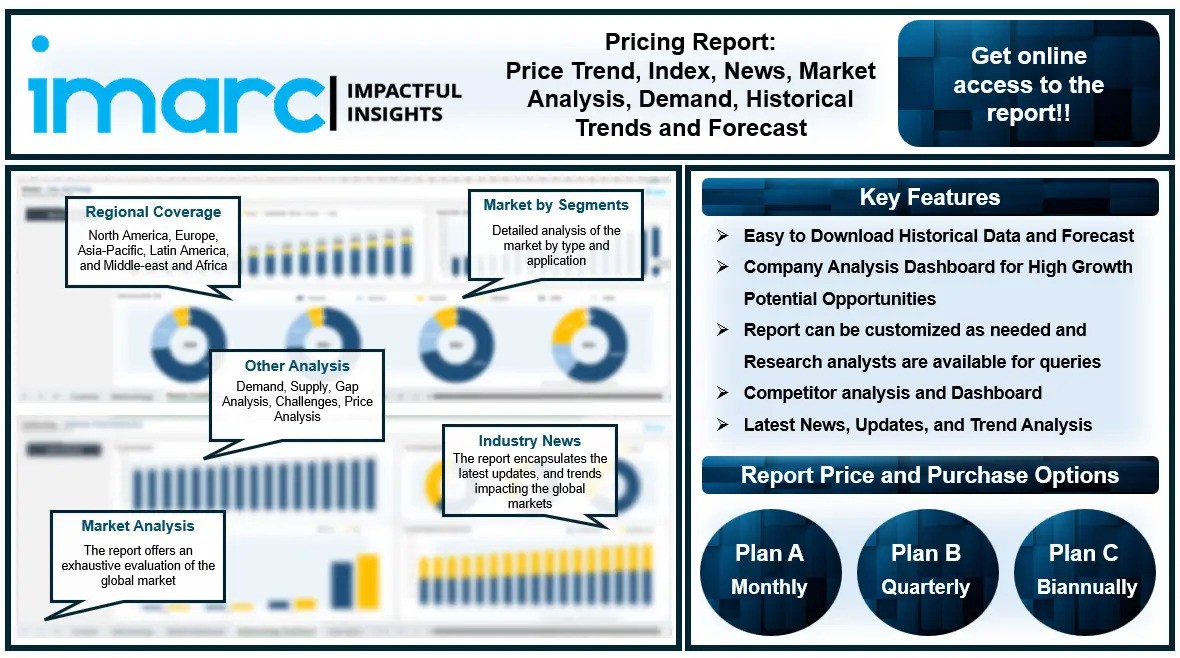

The latest report by IMARC Group, titled “Silver Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data,” provides a thorough examination of Silver Prices. This report delves into the price of Silver globally, presenting a detailed analysis, along with an informative Silver price chart. Through comprehensive price analysis, the report sheds light on the key factors influencing these trends. Additionally, it includes historical data to offer context and depth to the current pricing landscape. The report also explores the Silver demand, analyzing how it impacts market dynamics. To aid in strategic planning, the price forecast section provides insights into price forecast, making this report an invaluable resource for industry stakeholders.

Silver Prices Analysis – Last Quarter:

- United States: 748548 USD/MT (H2 2023 Avg Price)

- China: 807940 USD/MT (H2 2023 Avg Price)

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting Silver price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/silver-pricing-report/requestsample

Silver Price Trend- Fourth Quarter

Silver is a soft, white, lustrous metal with high electrical and thermal conductivity, making it ideal for various industrial applications. It occurs both as a free metal and in minerals such as argentite and galena. Historically, silver has been used for coinage, jewelry, and decorative items due to its attractive appearance and resistance to oxidation.

In modern times, its applications have expanded to include electronics, due to its excellent conductive properties, and in the medical field for its antibacterial qualities. Silver is also used in photography, solar panels, and various chemical processes. The metal is extracted through mining and refining of ores and is often produced as a byproduct of copper, gold, and lead mining. Its value and demand are influenced by both industrial applications and its role as a precious metal for investment.

Silver Industry Analysis

The silver market is driven by surging industrial demand. This metal is widely used in electronics, solar panels, and various chemical applications due to its superior conductive and reflective properties. The growing adoption of renewable energy technologies, particularly photovoltaic cells in solar panels, has significantly increased the demand for silver. Additionally, the expansion of 5G technology and increasing production of electronic devices have further bolstered industrial consumption.

Besides this, extensive investment demand also plays a crucial role in influencing silver prices. Investors often turn to silver as a safe-haven asset during times of economic uncertainty, inflation, or currency devaluation. This behavior can lead to substantial price fluctuations.

Another critical factor is the silver mining production levels and the availability of silver as a byproduct of other mining activities, such as gold and copper. Disruptions in mining operations due to environmental regulations, labor strikes, or geopolitical issues can create supply constraints, influencing prices.

Moreover, macroeconomic trends, including interest rates, inflation rates, and currency strength, particularly the US dollar, have significant impacts. Since silver is traded in US dollars, a weaker dollar makes silver cheaper for investors holding other currencies, boosting demand and prices. Conversely, higher interest rates can increase the opportunity cost of holding non-yielding assets like silver, potentially reducing investment demand.

Furthermore, speculative trading and market sentiment also affect silver prices. Futures market activities, where traders speculate on price movements, can lead to volatility.

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand.

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece.

- North America: United States and Canada.

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco.

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145