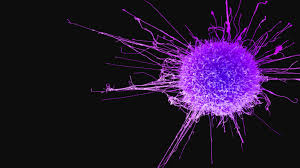

The India Cancer Insurance Market witnessed substantial growth, soaring from USD 6457.68 million in 2023 to USD 7897.74 million by 2032, at a robust CAGR of 6.33%. Cancer, one of the most formidable health challenges globally, imposes a significant financial burden on individuals and families. In India, where healthcare costs are rising, addressing this burden requires innovative solutions. This has led to the emergence of a specialized sector within the insurance industry – Cancer Insurance. This article delves into the dynamics of the India Cancer Insurance Market, exploring its growth, challenges, and impact.

Browse the full report at https://www.credenceresearch.com/report/india-cancer-insurance-market

Rising Incidence and Financial Strain:

India is witnessing a steady rise in cancer incidence, attributed to factors such as lifestyle changes, pollution, and an aging population. The burden of cancer not only affects physical and emotional well-being but also poses a substantial financial strain. Cancer treatment costs, including chemotherapy, radiation therapy, surgery, and medications, can be exorbitant, often pushing families into financial distress.

Role of Cancer Insurance:

Recognizing the need to mitigate this financial burden, the concept of cancer insurance has gained traction in India. Cancer insurance policies offer coverage specifically tailored to the diagnosis and treatment of cancer. These policies typically provide a lump-sum payout upon diagnosis, which can be utilized for various expenses, including medical bills, transportation costs, and even lifestyle adjustments necessitated by the illness.

Market Growth and Dynamics:

The India Cancer Insurance Market has witnessed significant growth in recent years, driven by increasing awareness, rising cancer incidence, and innovative product offerings by insurers. Both standalone cancer insurance policies and riders attached to health insurance plans are available in the market, catering to diverse consumer needs.

Moreover, advancements in medical technology and treatment modalities have positively influenced the market dynamics. With improved survival rates and better outcomes, individuals are increasingly recognizing the importance of financial preparedness through cancer insurance.

Challenges and Opportunities:

Despite its growth trajectory, the India Cancer Insurance Market faces several challenges. One significant challenge is the lack of awareness and understanding among the masses regarding the need for specialized cancer insurance. Many individuals remain underinsured or uninsured against the financial impact of cancer, exposing them to significant risk.

Additionally, affordability remains a concern for certain segments of the population, particularly in rural areas and lower-income groups. Ensuring accessibility and affordability of cancer insurance products to all strata of society is crucial for comprehensive coverage and financial protection.

However, these challenges also present opportunities for market players to innovate and expand their reach. Educational initiatives, awareness campaigns, and targeted outreach efforts can help bridge the knowledge gap and increase uptake of cancer insurance among the population.

Future Outlook:

The India Cancer Insurance Market holds immense potential for growth and innovation. As the country continues to grapple with the rising burden of cancer, the demand for specialized insurance solutions is expected to soar. Insurers are likely to introduce more comprehensive and affordable cancer insurance products, leveraging technology and data analytics to tailor offerings according to individual risk profiles.

Moreover, collaborations between insurers, healthcare providers, and government agencies can further enhance the accessibility and effectiveness of cancer insurance. By addressing barriers to adoption and ensuring comprehensive coverage, the India Cancer Insurance Market can play a pivotal role in alleviating the financial distress associated with cancer diagnosis and treatment.

Segmentations:

By Type

- Standalone Cancer Insurance Plans

- Cancer-specific Add-ons to Health Insurance Policies

- Comprehensive Health Insurance Plans Covering Cancer Treatment

By Coverage

- Basic Coverage Plans

- Premium Coverage Plans with Higher Sum Insured

- Plans with Coverage for Specific Stages of Cancer

By Payer Type

- Individual Policyholders

- Group Insurance Plans offered by Employers

- Government-backed Insurance Schemes

By Treatment Coverage

- Coverage for Surgery

- Coverage for Chemotherapy

- Coverage for Radiation Therapy

By Distribution Channel

- Direct Sales

- Insurance Agents and Brokers

- Online Sales Channels

- Corporate Tie-ups and Bancassurance Partnerships

By Region

- North India

- South India

- East India

- West India

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: sales@credenceresearch.com