The global demand for digital twins in oil and gas was valued at USD 7154.2 Million in 2022 and is expected to reach USD 307270.6 Million in 2030, growing at a CAGR of 60% between 2023 and 2030.The oil and gas industry, known for its complexity and high stakes, is undergoing a digital transformation, with the adoption of advanced technologies playing a pivotal role. Among these technologies, the concept of Digital Twins stands out, offering unprecedented opportunities for efficiency, safety, and innovation. Digital Twins, which are virtual replicas of physical assets, systems, or processes, are reshaping the landscape of the oil and gas market.

Browse the full report at https://www.credenceresearch.com/report/digital-twins-oil-and-gas-market

Understanding Digital Twins

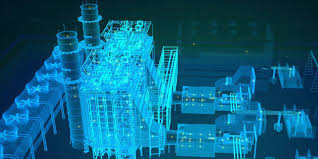

A Digital Twin is a dynamic, real-time digital counterpart of a physical entity, created to simulate, predict, and optimize performance. It integrates data from various sources, including sensors, historical records, and operational data, to create a comprehensive digital model. This model evolves with the physical asset, continuously updating itself to reflect the real-world counterpart’s current state.

In the context of the oil and gas industry, Digital Twins can be applied to various assets such as drilling rigs, pipelines, refineries, and even entire oilfields. By leveraging Internet of Things (IoT) devices, machine learning, and advanced analytics, these digital models provide insights that were previously unattainable.

Enhancing Operational Efficiency

One of the most significant advantages of Digital Twins is the ability to enhance operational efficiency. In an industry where downtime and inefficiencies can lead to substantial financial losses, optimizing operations is critical. Digital Twins enable predictive maintenance, allowing operators to anticipate equipment failures before they occur. This proactive approach reduces unplanned downtime and extends the lifespan of critical assets.

For instance, a Digital Twin of a drilling rig can monitor real-time data on vibration, temperature, and pressure. By analyzing this data, it can predict when a component is likely to fail, allowing maintenance teams to address issues before they escalate. This not only minimizes downtime but also reduces maintenance costs and improves safety.

Improving Safety and Risk Management

Safety is paramount in the oil and gas industry, where accidents can have catastrophic consequences. Digital Twins contribute to improved safety by providing a virtual environment to simulate and analyze potential hazards. Operators can test various scenarios, such as equipment malfunctions or emergency responses, without risking human lives or damaging physical assets.

Moreover, Digital Twins facilitate better risk management by offering a comprehensive view of operations. They can identify anomalies and deviations from normal operating conditions, enabling swift responses to potential risks. For example, a Digital Twin of a pipeline can detect leaks or pressure anomalies in real-time, allowing operators to take immediate action to prevent spills or explosions.

Optimizing Production and Asset Management

Digital Twins also play a crucial role in optimizing production and asset management. In oilfields, they can simulate reservoir behavior, helping engineers design more effective extraction strategies. By analyzing real-time data on reservoir conditions, operators can adjust production parameters to maximize yield and minimize environmental impact.

Furthermore, Digital Twins support asset management by providing detailed insights into asset performance and health. Operators can track the condition of equipment, monitor usage patterns, and make data-driven decisions on asset replacement or upgrades. This holistic approach ensures that assets are utilized optimally, reducing waste and enhancing overall productivity.

Driving Innovation and Collaboration

The adoption of Digital Twins is driving innovation in the oil and gas industry. By fostering a culture of data-driven decision-making, companies are exploring new ways to improve efficiency and sustainability. Digital Twins enable the integration of various technologies, such as artificial intelligence and blockchain, to create more robust and transparent operations.

Additionally, Digital Twins facilitate collaboration across different departments and stakeholders. Engineers, operators, and executives can access the same digital model, ensuring everyone is aligned with the current state of operations. This collaborative approach enhances communication, accelerates problem-solving, and drives continuous improvement.

Key Players

- Ansys Inc

- General Electric

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- PTC Inc

- Robert Bosch GmbH

- SAP SE

- Siemens AG

- SWIM.AI

- Others

Segmentation

-

By Asset Digital Twins

- Upstream Assets

- Midstream Assets

- Downstream Assets

-

By Process Digital Twins

- Reservoir Simulation

- Drilling Operations

- Production Optimization

-

By Technology Integration

- Internet of Things (IoT)

- Sensors and Devices

- Advanced Analytics

-

By Software Platforms

- Simulation Software

- Data Analytics Platforms

- Visualization Software

-

By Lifecycle Phases

- Design and Construction

- Operations and Maintenance

- Decommissioning

-

By Collaborative Digital Twins

- Supply Chain Collaboration

- Ecosystem Integration

-

By Cloud-Based Solutions

- Cloud-Based Digital Twins

- Edge Computing

-

By Region

-

North America

- The U.S.

- Canada

- Mexico

-

Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Argentina

- Rest of Latin America

-

Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

-

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: sales@credenceresearch.com