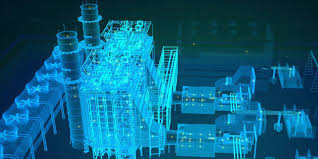

The global demand for augmented reality (AR) and virtual reality (VR) in oil and gas was valued at USD 250.8 million in 2022 and is expected to reach USD 1494.88 million in 2030, growing at a CAGR of 25.00% between 2023 and 2030.The oil and gas industry, traditionally characterized by heavy machinery, complex processes, and high risks, is increasingly turning to advanced technologies to enhance operational efficiency, safety, and cost-effectiveness. Among these technologies, Augmented Reality (AR) and Virtual Reality (VR) are making significant strides, revolutionizing various aspects of the sector. These immersive technologies are providing new ways to visualize and interact with complex data, streamline training, and improve maintenance and inspection processes.

Browse the full report at https://www.credenceresearch.com/report/augmented-reality-and-virtual-reality-in-oil-and-gas-market

Enhancing Training and Simulation

One of the most impactful applications of AR and VR in the oil and gas industry is in training and simulation. Traditionally, training personnel for high-risk environments such as offshore rigs or refineries involves substantial time and cost. VR offers a solution by creating realistic, immersive simulations of these environments where trainees can practice procedures and respond to emergencies without any risk to their safety. These virtual simulations can mimic various scenarios, from routine operations to rare and hazardous situations, providing comprehensive training experiences.

AR complements this by overlaying digital information onto the real world. For instance, when training on-site, AR can provide real-time, step-by-step guidance on complex machinery, ensuring that trainees understand the process thoroughly. This combination of VR and AR not only enhances the learning experience but also significantly reduces training costs and time.

Improving Maintenance and Inspection

Maintenance and inspection are critical components in the oil and gas industry, requiring meticulous attention to detail to prevent costly downtime and accidents. AR and VR technologies are proving invaluable in this area. AR can assist maintenance workers by overlaying digital schematics and operational data onto physical equipment, guiding them through repairs and inspections with precision. This reduces the likelihood of human error and ensures that maintenance is conducted efficiently and accurately.

VR, on the other hand, allows engineers and inspectors to conduct virtual walkthroughs of facilities, identifying potential issues without being physically present. This is particularly beneficial for inspecting remote or hazardous locations, where physical access can be challenging and dangerous. By using VR for preliminary inspections, companies can prioritize and plan physical inspections more effectively, ensuring that resources are allocated efficiently.

Enhancing Collaboration and Remote Assistance

The global nature of the oil and gas industry means that expertise is often scattered across different locations. AR and VR facilitate better collaboration and remote assistance by allowing experts to interact with on-site personnel in real-time, regardless of their physical For instance, using AR, an engineer in a central office can see exactly what a field worker is seeing and provide real-time guidance as if they were on-site. This not only speeds up problem-solving but also reduces the need for experts to travel to remote or dangerous locations.

VR takes remote collaboration a step further by creating virtual meeting spaces where teams can gather to discuss projects, review plans, and conduct virtual walkthroughs of facilities. These virtual environments can be designed to replicate actual sites, providing a realistic context for discussions and decision-making. This enhances communication and ensures that all team members have a clear understanding of the project, regardless of their geographical

Driving Innovation and Future Prospects

The integration of AR and VR in the oil and gas industry is driving innovation and opening new possibilities for the future. These technologies are not only improving existing processes but also enabling the development of new ones. For instance, in exploration and drilling, VR can be used to create detailed geological models, allowing geologists and engineers to explore potential sites in a virtual environment before any physical drilling takes place. This reduces the risk and cost associated with exploratory drilling.

Moreover, AR and VR are playing a crucial role in the design and planning of new facilities. By creating virtual prototypes, companies can test and optimize designs before construction begins, identifying potential issues and making necessary adjustments early in the process. This not only ensures that facilities are built to the highest standards but also reduces the time and cost associated with design changes during construction.

Key Players

- BP Plc

- Chevron

- ExxonMobil

- Shell

- Saudi Aramco

- GE Digital

- Rockwell Automation

- Others

Segmentation

- By Training and Simulation

- Immersive Training Programs

- AR-based On-site Training

- By Maintenance and Inspection

- Virtual Inspection

- AR-guided Maintenance

- By Safety and Emergency Response

- VR-based Emergency Drills

- AR-enabled Safety Information

- By Design and Planning

- VR-based Facility Design

- AR-assisted Construction

- Data Visualization and Analytics

- AR for Data Overlays

- VR Data Visualization

- By Remote Collaboration

- VR-based Remote Meetings

- AR-enhanced Video Conferencing

- By Equipment Operation and Control

- AR-based Equipment Control

- VR-based Equipment Simulation

- By Drilling and Well Planning

- VR-based Well Planning

- AR-guided Drilling Operations

- By Human-Machine Interface (HMI)

- VR-based Control Rooms

- AR-enabled Wearables

- By Environmental Monitoring

- VR-based Environmental Simulations

- AR-enabled Environmental Data Visualization

- By Component

- Hardware

- Software

- Services

- By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

- North America

Browse the full report at https://www.credenceresearch.com/report/augmented-reality-and-virtual-reality-in-oil-and-gas-market

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: sales@credenceresearch.com

Website: www.credenceresearch.com