The global demand for 3D printing in oil and gas was valued at USD 215.8 million in 2022 and is expected to reach USD 1190.73 million in 2030, growing at a CAGR of 23.80% between 2023 and 2030.The oil and gas industry, a cornerstone of global energy supply, has traditionally relied on conventional manufacturing processes. However, the advent of 3D printing, also known as additive manufacturing, is revolutionizing this sector by offering innovative solutions to long-standing challenges. This technology is set to enhance efficiency, reduce costs, and minimize environmental impact, making it a critical tool for the future of oil and gas operations.

Browse the full report at https://www.credenceresearch.com/report/3d-printing-in-oil-and-gas-market

Enhancing Operational Efficiency

One of the most significant advantages of 3D printing in the oil and gas market is the ability to streamline and expedite the production of complex components. Traditional manufacturing methods can be time-consuming and labor-intensive, often requiring multiple stages and specialized tooling. In contrast, 3D printing can produce intricate parts directly from digital models, reducing lead times and simplifying the supply chain.

For example, components such as nozzles, valves, and impellers, which typically require complex geometries, can be printed on-demand. This not only accelerates the production process but also allows for rapid prototyping and testing of new designs. As a result, companies can innovate more quickly, responding to changing market demands and technological advancements with greater agility.

Cost Reduction and Inventory Management

The financial implications of 3D printing are particularly compelling. By adopting additive manufacturing, oil and gas companies can significantly cut down on production costs. Traditional methods often involve high material wastage and the need for extensive machining, both of which are minimized with 3D printing. This technology uses only the necessary amount of material to build a part layer by layer, resulting in substantial savings on raw materials.

Moreover, 3D printing supports a shift from mass production to more localized, on-demand manufacturing. This can drastically reduce inventory costs, as companies no longer need to maintain large stocks of spare parts. Instead, they can print components as needed, reducing storage requirements and mitigating the risk of obsolescence. This capability is especially valuable in remote or offshore locations where supply chain logistics are challenging and expensive.

Environmental Benefits

In addition to economic and operational advantages, 3D printing offers significant environmental benefits. The oil and gas industry faces increasing pressure to reduce its carbon footprint and adopt more sustainable practices. Additive manufacturing can contribute to these goals by reducing waste and energy consumption during production.

Traditional manufacturing processes often generate considerable waste, with excess material being discarded. 3D printing, however, is inherently more efficient, using only the material required for the final product. This not only conserves resources but also lowers the environmental impact of manufacturing activities. Furthermore, the potential to produce parts on-site reduces the need for transportation, thereby cutting down associated emissions.

Case Studies and Applications

Several oil and gas companies have already begun integrating 3D printing into their operations with promising results. For instance, Shell has used 3D printing to create prototype parts for testing and to manufacture custom tools for specific projects. Similarly, GE Oil & Gas has leveraged this technology to produce fuel nozzles and other critical components, achieving notable improvements in performance and durability.

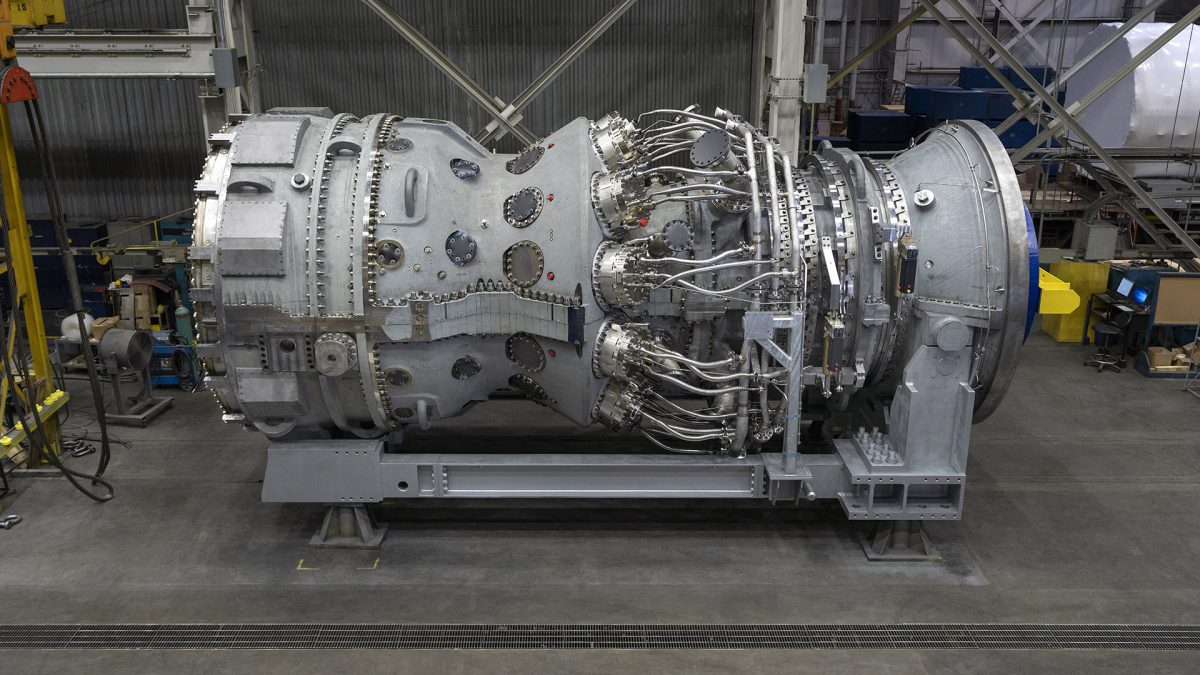

Another notable example is the collaboration between BP and Siemens to explore the use of 3D printing for creating spare parts for turbines and compressors. This partnership aims to enhance the reliability and efficiency of critical equipment while reducing downtime and maintenance costs.

Challenges and Future Prospects

Despite its potential, the adoption of 3D printing in the oil and gas market is not without challenges. High initial investment costs, the need for skilled personnel, and concerns about the durability and reliability of printed parts are among the barriers to widespread implementation. However, as the technology matures and becomes more accessible, these obstacles are expected to diminish.

Looking ahead, the future of 3D printing in the oil and gas industry appears promising. Continued advancements in materials science, printing techniques, and digital design tools will further enhance the capabilities and applications of additive manufacturing. As companies continue to recognize and harness its benefits, 3D printing is poised to play an increasingly integral role in shaping the future of oil and gas operations, driving innovation, efficiency, and sustainability.

Key Players

- Proto Labs, Inc.

- SLM Solutions Group AG

- EnvisionTEC GmbH

- Stratasys Ltd.

- 3D Systems Corporation

- Materialise NV

- Optomec Inc.

- Voxeljet AG

- The Exone Company

- Arcam Group

- Others

Segmentation

- By Manufacturing Of Components

- Customized parts

- Prototyping

- By Supply Chain Optimization

- On-Demand Manufacturing

- Reducing Dependence on Suppliers

- By Materials Development

- Advanced Materials

- High-Performance Polymers and Metals

- By Retrofitting And Maintenance

- Retrofitting existing components

- Replacement parts

- By Tooling And Equipment Production

- Custom Tooling

- Jigs and Fixtures

- By Prototyping And Design Optimization

- Rapid Prototyping

- Design Iterations

- By Reducing Weight And Enhancing Performance

- Topology Optimization

- Complex Geometries

- By Drilling And Exploration Applications

- Customized Drilling Tools

- Sensor Housings

- By Sustainability And Environmental Impact

- Reduced Material Waste

- Localized Production

- By Certification And Standardization

- Industry Standards

- Regulatory Compliance

- By Collaborative Initiatives

- Partnerships and consortia

- By Remote And Harsh Environments

- On-Site 3D Printing

- Adaptation to Extreme Conditions

- By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

- North America

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: sales@credenceresearch.com