Summary:

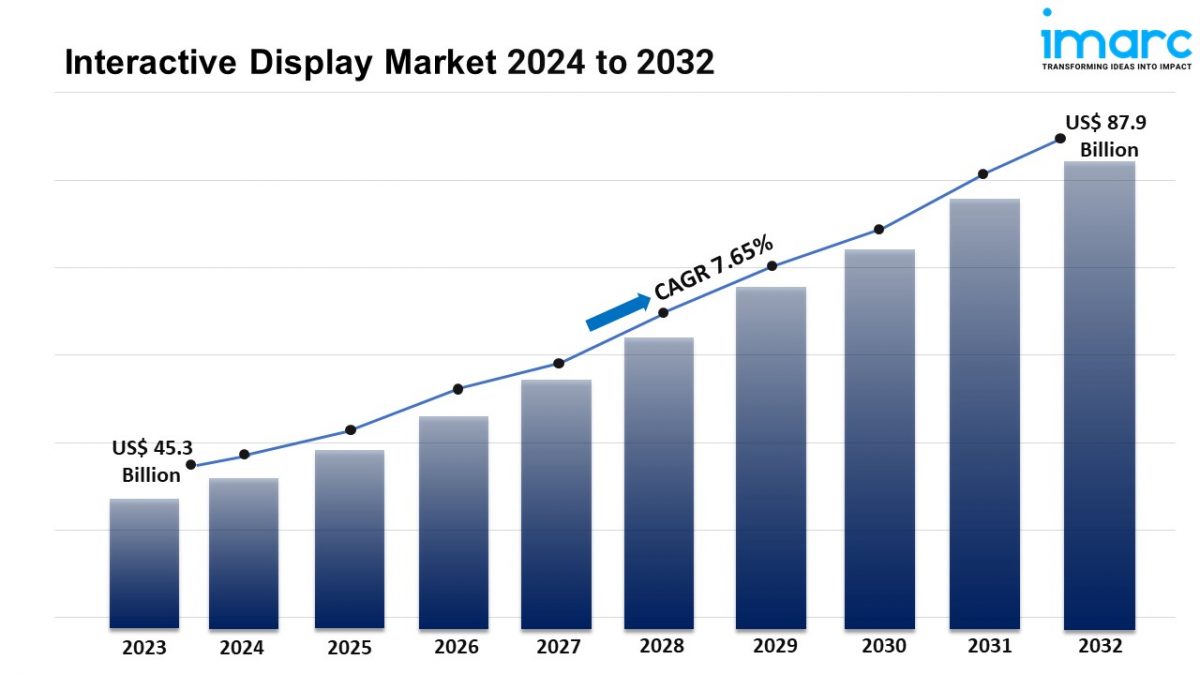

- The global interactive display market size reached USD 45.3 Billion in 2023.

- The market is expected to reach USD 87.9 Billion by 2032, exhibiting a growth rate (CAGR) of 7.65% during 2024-2032.

- North America leads the market, accounting for the largest interactive display market share.

- Interactive kiosks account for the majority of the market share in the display type segment due to their widespread adoption across various industries.

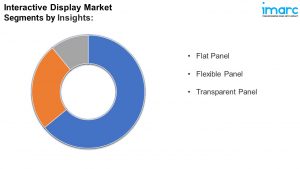

- Flat panel holds the largest share in the interactive display industry.

- 32–65” remain a dominant segment in the market, as they are large enough to provide clear and detailed visuals.

- LCD represents the leading technology segment.

- BFSI dominates the market as they require enhanced customer engagement and improved operational efficiency.

- The rising product adoption in education sector is a primary driver of the interactive display market.

- The increasing popularity of interactive advertisements is reshaping the interactive display market.

Industry Trends and Drivers:

- Growing demand for enhanced learning experience:

The growing demand for interactive displays in the education sector is driven by the need to improve student engagement and learning outcomes. Schools and universities are adopting smart classrooms, integrating interactive whiteboards and touchscreens to create dynamic, collaborative learning environments. These displays enable students to interact directly with content, promoting a more hands-on learning experience. As the focus on personalized and digital education increases, interactive displays are being viewed as essential tools for improving comprehension and participation in both in-person and remote settings. This trend is expected to accelerate as education systems worldwide continue to emphasize the importance of digital literacy and technological integration in the classroom.

- Rising adoption in corporate sector:

In the corporate sector, interactive displays are gaining popularity due to their ability to improve communication and collaboration. Businesses are using these displays in conference rooms, training sessions, and brainstorming meetings to facilitate real-time collaboration and enhance presentations. The increasing trend toward hybrid work environments has also amplified the need for advanced communication tools, making interactive displays a preferred choice for virtual meetings and remote collaboration. The integration of touchscreens, video conferencing capabilities, and cloud-based sharing functions allows teams to work more efficiently, leading to increased productivity and streamlined decision-making processes. As a result, the adoption of interactive displays is expected to continue growing within corporate settings.

- Increasing popularity of advertising applications:

Interactive displays are becoming increasingly popular in the retail sector, where they are used to create immersive and engaging customer experiences. Retailers are deploying interactive kiosks, digital signage, and touchscreen displays to attract customers, provide personalized product recommendations, and enhance in-store experiences. These displays enable customers to interact with products, browse inventories, and make purchases with ease. Additionally, advertisers are leveraging interactive displays for digital out-of-home (DOOH) campaigns, offering engaging content that captures consumer attention. The growing emphasis on customer engagement and personalized marketing strategies is a key driver for the adoption of interactive displays in retail and advertising environments.

Request Sample For PDF Report: https://www.imarcgroup.com/interactive-display-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Display Type Insights:

- Interactive Kiosk

- Interactive Video Wall

- Interactive Tables

- Interactive Monitor

- Interactive Whiteboard

Interactive kiosks account for the majority of shares due to their versatility and widespread applications across various industries.

Panel Type Insights:

- Flat Panel

- Flexible Panel

- Transparent Panel

Flat panel dominates the market due to their slim, sleek design, which makes them ideal for space-saving applications in classrooms, corporate settings, and retail environments.

Panel Size Insights:

- 17–32”

- 32–65”

- 65” and Above

32–65” represents the majority of shares as these displays are large enough to provide clear, detailed visuals while still being manageable in size.

Technology Insights:

- LCD

- LED

- OLED

- Others

LCD holds the majority of shares as they are relatively inexpensive to produce compared to other display technologies like OLED.

Application Insights:

- Retail

- Hospitality

- Healthcare

- Transportation

- BFSI

- Corporate

- Entertainment

- Education

- Others

BFSI sector exhibits a clear dominance due to its need for enhanced customer engagement, improved operational efficiency, and the increasing shift toward digitalization.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds the leading position owing to a large market for interactive display driven by the increasing adoption of advanced technologies in numerous industries.

Top Interactive Display Market Leaders:

- BenQ Corporation (Qisda Corporation)

- Cisco Systems Inc.

- Egan Teamboard Inc.

- Horizon Display Inc

- Intuiface

- LG Display Co. Ltd.

- Microsoft Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co. Ltd.

- SMART Technologies ULC (Hon Hai Precision Industry Co., Ltd.)

- ViewSonic Corporation

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us.

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.