Summary:

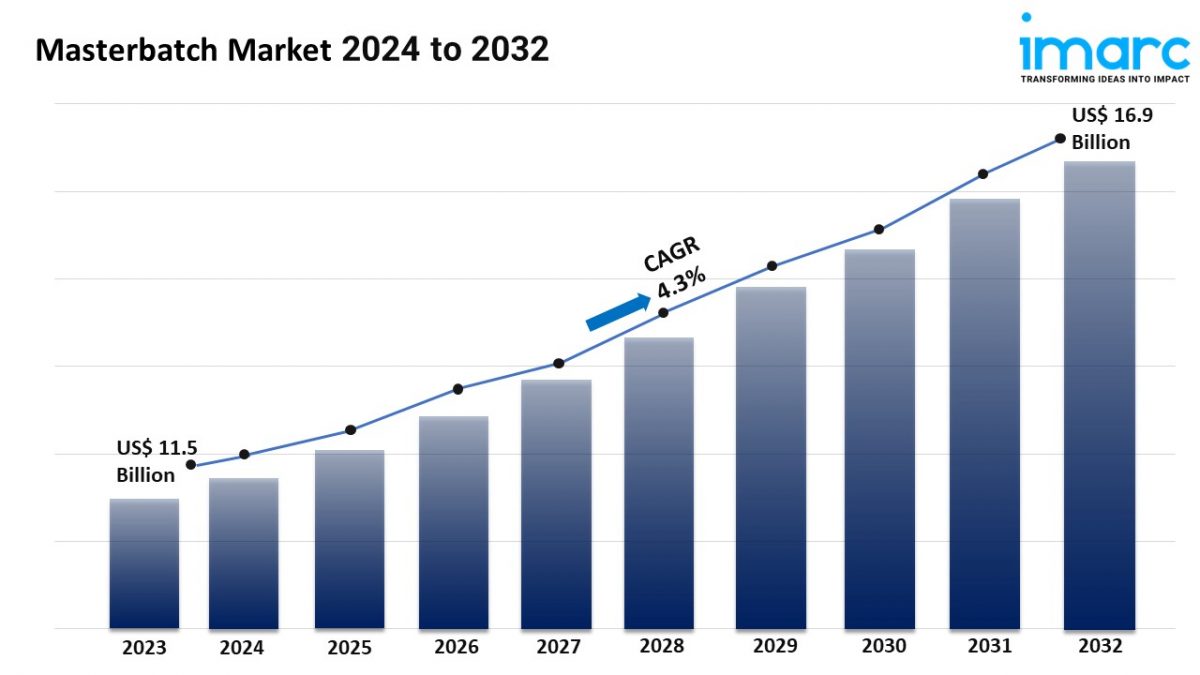

- The global masterbatch market size reached USD 11.5 Billion in 2023.

- The market is expected to reach USD 16.9 Billion by 2032, exhibiting a growth rate (CAGR) of 4.3% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest masterbatch market share.

- White accounts for the majority of the market share in the type segment due to its opacity and clarity.

- PP holds the largest share in the masterbatch industry.

- Packaging remains a dominant segment in the market, due to its use in food and beverages, pharmaceuticals, and other industries.

- The rising packaging industry is a primary driver of the masterbatch market.

- The escalating demand for sustainable solutions is also reshaping the masterbatch market.

Industry Trends and Drivers:

- Growing Applications in Packaging Industry:

The packaging industry is a key driver of demand for masterbatches, significantly contributing to market growth. Masterbatches, which are concentrated mixtures of pigments and additives, are vital in producing visually appealing and functional packaging materials. As the need for innovative packaging solutions such as flexible, rigid, and smart packaging grows, manufacturers increasingly use masterbatches to achieve specific colors, effects, and functional properties. For example, in food packaging, masterbatches can provide UV protection, antimicrobial properties, and enhanced barrier performance, which are crucial for maintaining product safety and extending shelf life. The rise of e-commerce has also heightened the demand for masterbatches, as companies seek secure, durable, and aesthetically pleasing packaging to attract consumers and protect goods during transit.

- Demand for Sustainable Plastics:

The growing focus on sustainability and environmental protection is a key factor driving the expansion of the masterbatch market. With increasing pressure from consumers and regulatory bodies to reduce plastic waste and promote the use of eco-friendly materials, manufacturers are shifting toward biodegradable and bio-based plastics. These types of plastics require specialized masterbatches to enhance their color and performance while maintaining their eco-friendly properties. Eco-friendly masterbatches are designed to preserve the quality and functionality of biodegradable plastics, ensuring that the final products adhere to environmental standards. Additionally, there is a rising demand for sustainable packaging solutions across various industries, including food and beverages, cosmetics, and consumer goods. These sectors are increasingly looking for packaging that supports recyclability and minimizes carbon footprint, further driving the demand for masterbatches that facilitate these green objectives.

- Technological Advancements:

One of the key factors driving the masterbatch market is the technological advancements in polymer processing. Innovations in extrusion and compounding technologies have significantly improved the efficiency and quality of masterbatch production. Modern equipment enables more effective dispersion of pigments and additives, leading to better color uniformity and enhanced performance of plastic products. Additionally, the development of new polymer blends and composites has broadened the applications for masterbatches across various sectors, such as automotive, packaging, and construction. These technological advancements lower production costs and also increase output, making masterbatches more affordable and attractive to manufacturers. Moreover, the integration of automation and digitalization into production processes allows for precise formulation and consistent product quality, further boosting the demand for high-performance masterbatches.

Request Sample For PDF Report: https://www.imarcgroup.com/masterbatch-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

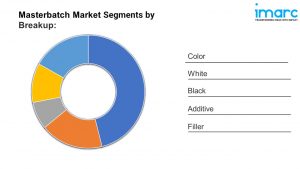

Breakup by Type:

- Color

- White

- Black

- Additive

- Filler

White accounts for the majority of shares as it provides opacity and brightness to plastics.

Breakup by Polymer Type:

- PP

- LDPE/LLDPE

- HDPE

- PVC

- PUR

- PET

- PS

- Others

PP dominates the market due to its chemical and heat stability, cost-effectiveness, and excellent durability.

Breakup by Application:

- Packaging

- Building & Construction

- Consumer Goods

- Automotive

- Textile

- Agriculture

- Others

Packaging exhibits a clear dominance as masterbatches provides color, UV protection, and antimicrobial properties to packaging material.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific holds the leading position owing to a large market for masterbatch driven by rapid urbanization and expanding industries.

Top Masterbatch Market Leaders:

- Schulman Inc.

- Americhem, Inc.

- Ampacet Corporation

- Cabot Corporation

- Clariant AG

- Gabriel-Chemie GmbH

- Hubron (International) Ltd.

- Penn Color Inc.

- Plastiblends India Ltd.

- Plastika Kritis S.A.

- PolyOne Corporation

- Polyplast Müller GmbH

- RTP Company Inc

- Tosaf Compounds Ltd.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.