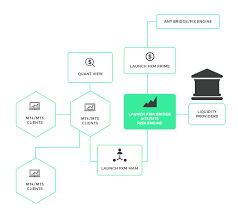

An MT4 liquidity bridge is a third-party software that enables traders to engage with liquidity providers digitally via one of the most global platforms – MetaTrader 4. It basically establishes a communication channel between the brokerage and third-party services, allowing regular investors to reach multiple brokers and liquidity providers.

How does a liquidity bridge function?

A liquidity bridge connects an investor’s account to a Forex liquidity provider via the MT4 platform. Additionally, such innovation is used to execute transactions from a particular brokerage as well as to monitor price movements. Furthermore, most liquidity bridges include a designed interface to the broker’s prices. This option permits orders to be issued directly from your MT4 platform without needing an additional data feed.

What are the benefits of using an MT4 liquidity bridge?

Utilizing an MT4 liquidity bridge has various advantages, such as the following:

Firstly, retail investors now have more access to more brokers than they could through their official communication channel since an MT4 liquidity bridge enables customers to connect to a wide range of FX liquidity providers.

The second benefit offered by this solution is cost-effective installation and configuration. Note that many third-party save investors time and money by providing services where they set up and implement an MT4 liquidity bridge.

The third aspect that will attract new users is the highly customizable transaction sending/receiving system. Most modern liquidity bridges can be easily set up to transfer orders and other data from a specific brokerage. Furthermore, most of these third-party software applications include a plug-and-play real-time data feed system. These technologies enable traders to obtain consistent price levels without investing additional resources in data feeds, which could be really expensive.

It means that any ongoing changes will be transmitted in real-time instead of traditional data streams, which only offer periodic updates. Moreover, thanks to the MTR4 server, it is possible to get quick updates when connected to a particular broker. Those with a direct link to an investor’s trading account have the possibility to get the latest updates thanks to the MT4 server.

How you should choose an MT4 liquidity bridge

Frequency, stability, risk management tools, or convenience of use are the essential criteria to examine before choosing an MT4 liquidity bridge.

Frequency is among the top priorities when looking for liquidity. Connecting your platform to a preferred MT4 liquidity provider and simulating the same chart with available configuration setups is the best approach to test the speed and frequency of a specific option. Once finished, you may determine which platform is the fastest to proceed further.

Reliability. Selecting an untrusted firm will cause discomfort and may not fix the problem you were having from the beginning. Do some research and find a firm that will communicate with you constantly from the start and help with everything you need.

Tools for Risk Management. It would be best if you had multiple perspectives on the product before making a final decision. To help you with that, you should definitely join the Forex communities. That being said, join several forums and read about it on reliable and trustworthy websites.

Simplicity. Since certain MT4 liquidity bridges are more convenient to use than others, it’s essential to do your homework before making a deal. As already mentioned, do proper research, since you will invest your money and a lot of effort into it, making it worth it.

Effect of liquidity bridge on traders:

A liquidity bridge can greatly influence traders since it provides unique chances for people who might be unable to trade with their preferred broker. Furthermore, making real-time modifications saves you time & expenses compared to manually configuring your MT4 platform.

Lastly, using a direct link between a broker’s server and an investor’s MT4 server via a third-party service provider, an MT4 liquidity bridge offers a unique chance to provide several benefits for retail Forex traders, including enhanced access to additional brokers and faster active trades. This technology enables a customizable order sending/receiving method, as well as real-time account updates between the broker’s server and the investor’s MT4 server, which is preferable to other types of data feed.